Hearing Insurance For Seniors for Beginners

Manhattan Life Assurance Fundamentals Explained

Table of ContentsThe smart Trick of Boomerbenefits Com Reviews That Nobody is DiscussingSome Known Details About Largest Retirement Community In Florida Boomerbenefits Com Reviews Fundamentals ExplainedSome Known Details About Boomerbenefits.com Reviews The 30-Second Trick For Boomerbenefits.com ReviewsNot known Incorrect Statements About Medigap Plan G

This might consist of points like pay stubs, financial institution statements, or earnings tax return info. If you're enlisted in the QMB program, you'll need to reapply for it yearly. This is due to the fact that your income as well as resources may alter from one year to the next. Your state's Medicaid office can provide you details about when and also just how to reapply.

You can sign up in the Bonus Assistance program on the SSA website. Once you're enrolled in Bonus Aid, the SSA will review your income and resource standing annually, typically at the end of August. Based upon this evaluation, your Additional Aid advantages for the future year may stay the very same, be changed, or be ended.

To find out more concerning the QMB program in your state, call your state's Medicaid office. They can aid you figure out if you're qualified and offer you all the info needed to use. The information on this internet site might assist you in making individual decisions concerning insurance policy, yet it is not planned to supply suggestions concerning the purchase or use of any type of insurance or insurance policy products.

The Ultimate Guide To Hearing Insurance For Seniors

On April 1, 2016, the majority of Iowa Medicaid programs were signed up with with each other into one handled treatment program called IA Health and wellness Web link. Many existing Medicaid participants were registered in IA Wellness Link on April 1, 2016, as well as most new participants that become eligible after April 1, 2016, will certainly additionally be enrolled in IA Health and wellness Web Link - dental and vision insurance for seniors.

Medicaid attends to some solutions not covered under Medicare, such as oral costs as well as some prescription medications. If your complete countable earnings or sources are greater than the QMB limitations, there are various other program you may get approved for: Clinically Clingy: Ask the DHS workplace regarding Medically Needy if you have great deals of clinical expenses as well as not nearly enough cash to foot the bill.

Top Guidelines Of Boomerbenefits Com Reviews

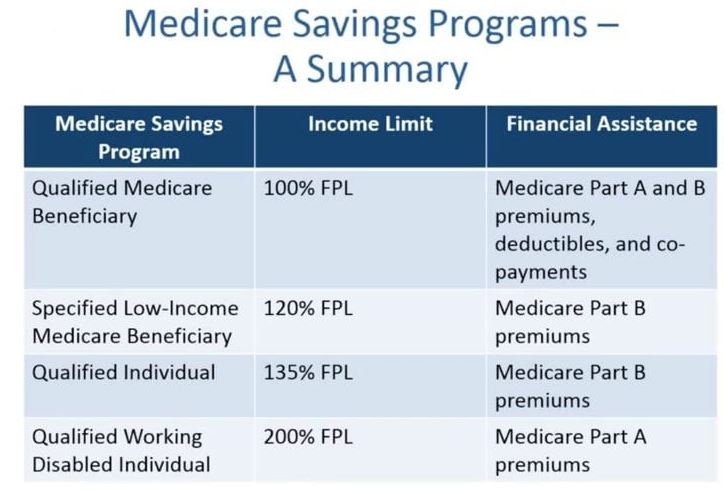

Next off, we analyze the difference in between initial Medicare and also Medicare Benefit with respect to QMB. We look at the various other three programs that aid with Medicare prices.

The QMB Medicare financial savings program can assist people with reduced revenue pay their Medicare prices. The QMB program is one of 4 state-run programs that help people that can not manage their Medicare prices.

An individual that is registered in QMB is additionally enlisted in Medicaid. The QMB program spends for the following: Component A monthly premiums, Part B regular monthly premiumscopaymentscoinsurancedeductibles, In addition, QMB aids with prescription costs. The program does not permit pharmacies to bill a person greater than $3. 90 for a prescription medication covered under Medicare additional info Component D.The earnings eligibility is the exact same in the majority of states, in addition to Alaska and also Hawaii, where they might be higher.

The Greatest Guide To Manhattan Life Assurance

This implies that even more than 1 in 8 Medicare beneficiaries are in the program. Whether a person is enrolled in initial Medicare or Medicare Advantage, they are qualified for QMB if they meet the earnings and also resource needs.

With this in mind, also if a person thinks they may not qualify for a program, they may wish to apply. Below are the descriptions as well as eligibility demands of each program.

An individual has to use for the QI program every year. The program accepts applications on a first-come, first-served basis, but it provides concern to a person that is currently registered. Right here are the qualification requirements for income as well as sources in many states for QI: An individual's monthly earnings need to be under $1,456.

6 Simple Techniques For Plan G Medicare

An individual's resources need to be under $4,000. A married pair's resources must be under $6,000. A person might high quality for QDWI if among the below problems use: They do not get clinical help from their state. medicare select plans. They are a working handicapped person under age 65. They shed premium-free Component A when they returned to function.

The details on this internet site may help you in making personal decisions regarding insurance policy, yet it is not meant to provide advice relating to the acquisition or use any type of insurance or insurance coverage products. Healthline Media does not transact the company of insurance coverage in any manner and also is not licensed as an insurance provider or manufacturer in any kind of U.S (boomerbenefits com reviews).

Healthline Media does not suggest or support any type of third parties that might transact business of insurance policy.

Indicators on Largest Retirement Community In Florida You Should Know

09.24. 03-3 Individuals or couples must have earnings at or below 100% of the Federal Poverty Level (FPL). Existing regular monthly revenue and possession limits are posted on the Medicare web site. These limits apply to individual assets including money, financial institution accounts, stocks and also bonds. These limits do not include house, automobile or $1,500 in funeral fund.